PERSPECTIVES

IN THIS ISSUE

Retirement

Retirement income management

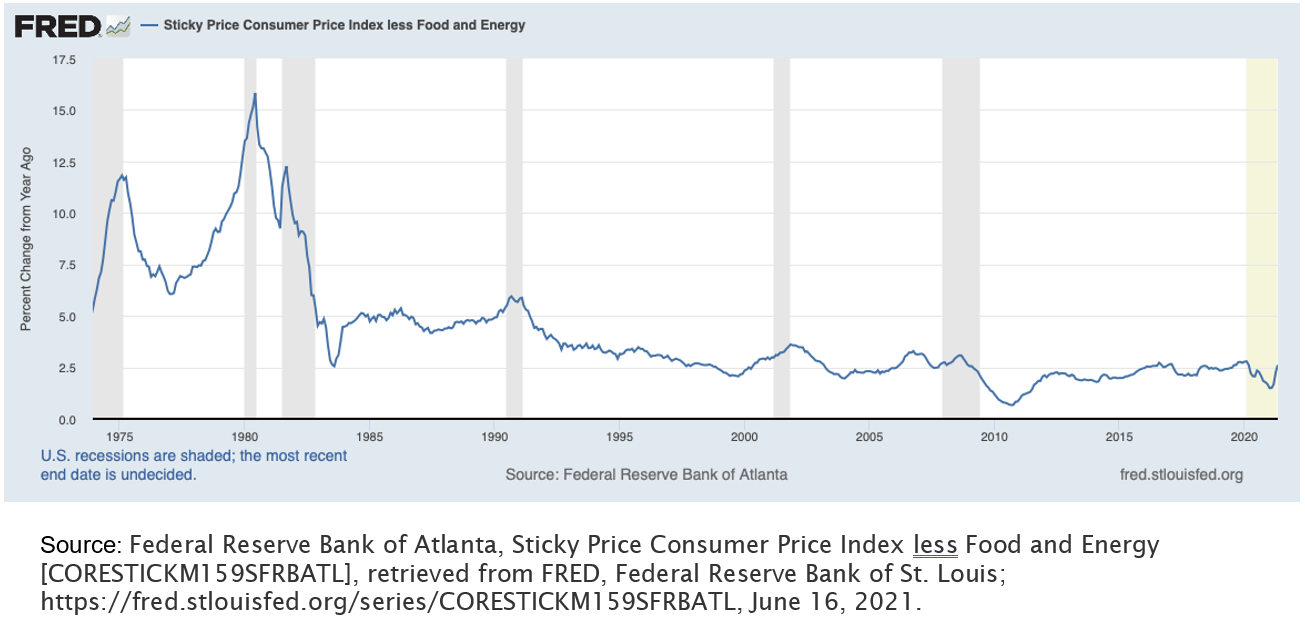

The scary word for retirees: Inflation

Estate planning

Marriage, Israeli style

Timing may be more important than many realize.

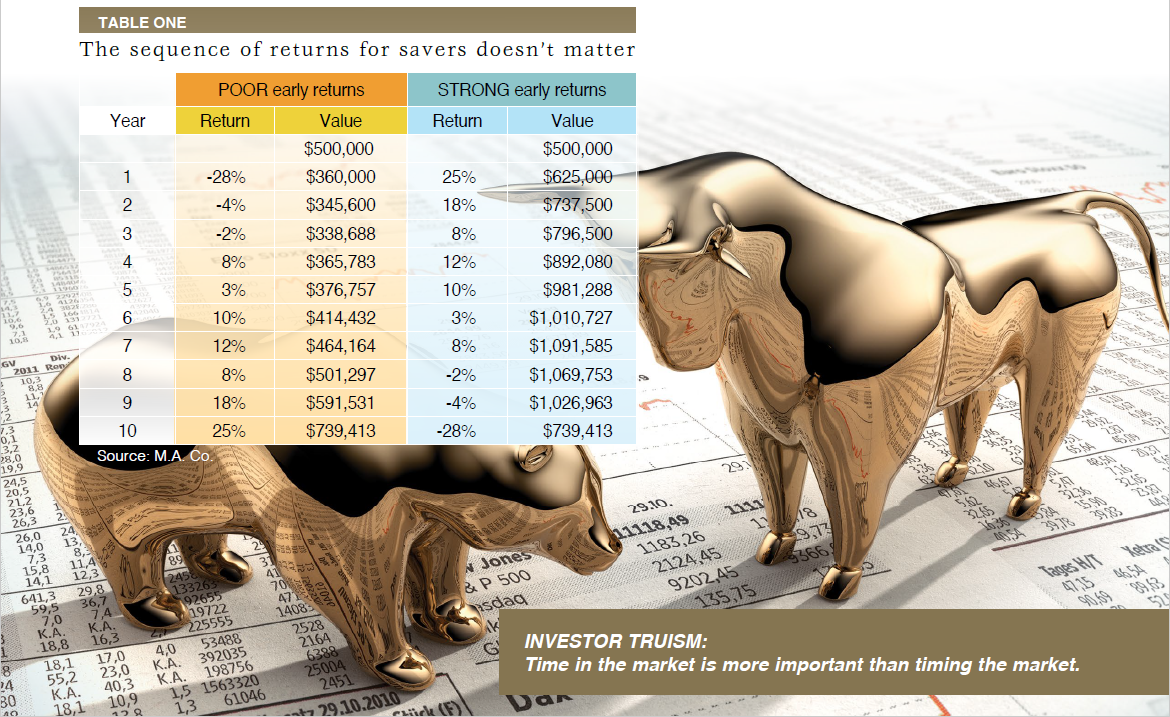

Investor truism: Time in the market is more important than timing the market.

For those with a long-term time horizon, volatility in the financial markets is relatively unimportant. Imagine that a portfolio has an aver- age 10-year return of a modest 5%, but the yearly returns are 25%, 18%, 3%, -4%, -28%, -2%, 8%, 10%, 12%, and 8%. Does it matter when the bad years occur?

It does not.

Table One below shows what would happen to $500,000 over ten years. On the left, the bear market comes early, pushing the portfolio into loss territo- ry, from which it recovers only after eight years. Putting the bull market first, as on the right, causes the port- folio to soar, but when the inevitable bear market ensues the losses apply to a much higher base. After 10 years, the portfolios arrive at the same final total.

For savers, the sequence of returns makes no difference at all. During the accumulation years of the financial life cycle, the important factor is being invested for as long as possible, to be confident of participating when the markets enjoy good years. Although one might hope to move the portfolio to cash at the top of the market, to avoid the bear market losses, very few investors have been able to do that successfully. Studies have shown that the most important market moves happen on just a very few days. The risk of market timing is being out of the market when another major uptick occurs.

A very different story for retirees

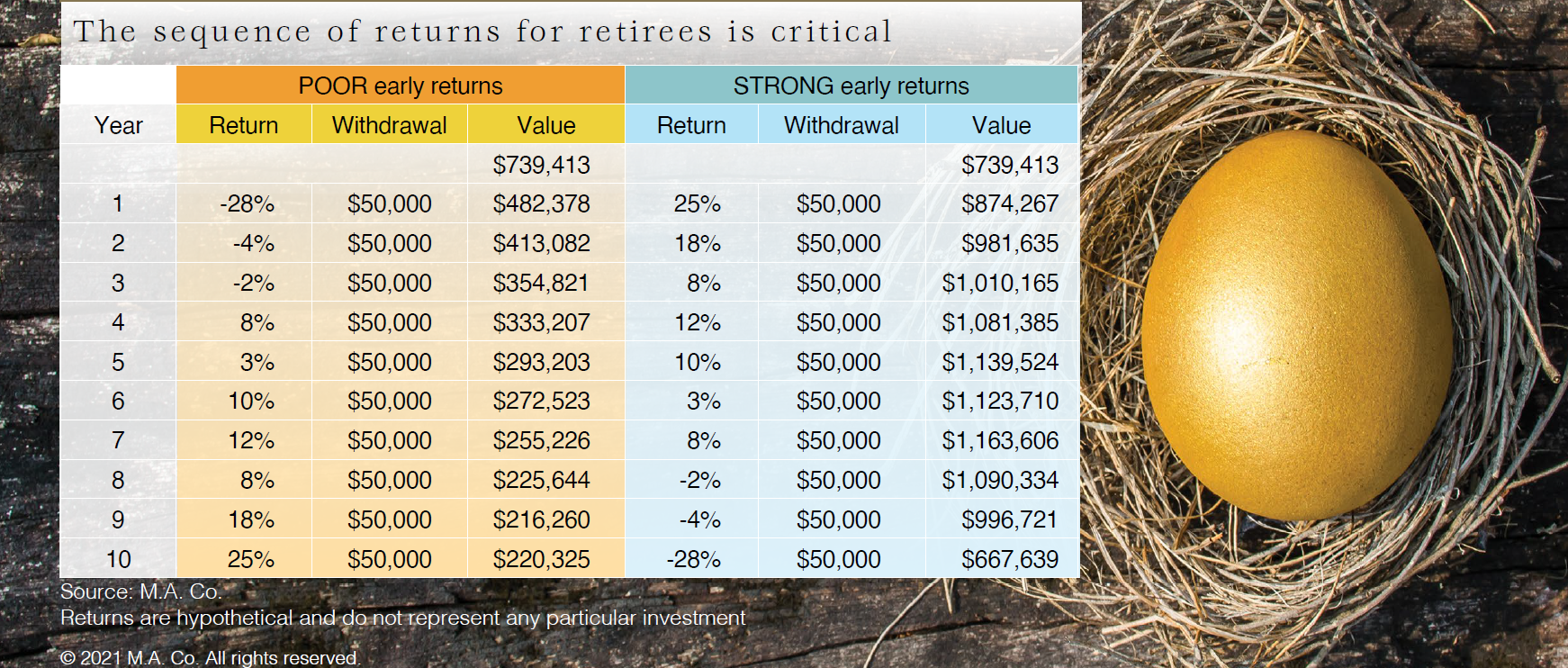

Retirees are concerned about outliving their financial resources, and with good reason. There are not many options for a retired person to boost his or her income other than selling assets. What is a sustainable withdrawal rate for a retiree? At what withdrawal rate can a retiree be reasonably confident that he or she won’t exhaust the available retirement capital?

Timing is everything, in trying to answer this question. If retirement commences during good economic times, the nest egg has a good chance of lasting decades. But retirement during a down year can wreak havoc on a retirement portfolio.

Let’s begin with the $739,413 that was saved in the earlier example. Assume that the retiree will need to draw down $50,000 annually, less than 7% of the account’s value. If there is a bull market when the withdrawals begin, the account will continue to grow despite the partial consumption. Table Two below uses the same sequence of investment returns as the savings examples.

After taking $500,000 out of the account over 10 years, a retiree who begins taking distributions during a bull market still has $667,639 to work with for the balance of the retirement.

However, a colleague who retires during a down market is not so fortunate. At the 10-year mark, this retiree’s portfolio is just 1/3 the value of that of one who retired during a bull market. The years of high returns are applied to a much lower account balance. When even modest withdrawals are coupled with poor investment return, a retirement nest egg can shrink quickly.

What can one do?

The choice of a start date for one’s retirement will be influenced by many personal factors. The health of the financial markets is typically low on the list of con- cerns, but these tables suggest that perhaps it shouldn’t be. There are steps that can be taken to protect against market vagaries.

Augment capital. Sell the house; move to smaller quarters; pocket $250,000 worth of capital gains tax free ($500,000 for couples) to supplement retirement capital.

Reduce spending. Someone who already has retired doesn’t have the luxury of becoming “unretired.” Unpleasant though it may be, when the markets head south, some spending plans may have to be deferred or eliminated.

Smooth portfolio volatility through sound asset allocation. By balancing portfolio assets among a variety of investment classes—large stocks, small stocks, short-term bonds, long-term bonds and so on—expected returns may fall within a narrower range. The lowest lows will be avoided—along with the highest highs—and the risk of outliving one’s money may be reduced.

We can help you

Unbiased investment management is an integral part of our service as trustee. But you don’t need to fund a trust to be able to call upon our professional expertise. We manage investment portfolios for a fee for individuals and families in a wide variety of situations.

This month, why not schedule a meeting with us to learn more?

Estate Planning

Marriage, Israeli style

Semone Grossman, a German Jew who had survived Nazi concentration camps, immigrated to New York after the war. He had a successful life. At his death in 2014, Grossman left the bulk of his $87 million estate to Ziona, his wife of 27 years, with whom he had had two children. However, the IRS denied the estate’s marital deduction and demanded some $35 million in estate taxes and over $7 million in accuracy-related penalties.

Wait, what?

Ziona was Semone’s third wife. He married his first wife, Hilda, in 1955, and they had two children. However, they separated in 1965, and Semone made regular payments to Hilda. In 1967, Semone started a new relationship with Katia. Before marrying her, Semone traveled to Mexico to obtain a divorce from Hilda. Although the marriage to Katia also produced two children, it ended by 1974.

That year Hilda filed a lawsuit to have the Mexican divorce declared null and void, a lawsuit that she won following a trial in 1976. The marriage to Katia was nul- lified, and Hilda was again the legal spouse of Semone. However, the couple never again cohabited, nor filed joint tax returns.

In 1986, then 56 years old, Semone became engaged to Ziona. Both of them had relatives in Israel, and they decided to marry there. Before the ceremony, Semone asked Hilda to cooperate in obtaining a divorce under Jewish religious law. She agreed. They appeared before a rabbi and obtained the necessary paperwork, which Semone brought with him to Israel. The Israeli religious authorities found everything in order, and permitted the wedding to go forward. After the marriage, the cou- ple returned to New York where they lived as a married couple for the rest of Semone’s life.

After his estate tax return was filed, the IRS some- how noticed that Semone and Hilda had never formally, legally divorced under New York law. Therefore, the Service reasoned, Hilda was the surviving spouse, not Ziona, even though Semone and Ziona had filed all their tax returns as married filing jointly, even though Hilda had filed all of her tax returns as a single person, and even though Hilda had not attempted to claim her marital share under New York law after Semone’s death. Under New York law, the IRS contended, Hilda remained the spouse. Hence, no marital deduction for property passing to Ziona.

The Tax Court concluded that the rule in New York has long been that the validity of a marriage is deter- mined by the place of its celebration. Semone and Ziona had satisfied Israel’s fairly strict rules for having a marriage in that country, and public policy generally favors recognition of second marriages.

Semone and Ziona probably could not have legally married in New York. That was in part the basis for the IRS denying the marital deduction. The Tax Court holds that fact was irrelevant to whether they could be legally married elsewhere.

Please do not hesitate to contact your dedicated Investment, Trust or Planning professional, if you have any questions.