Bill Stone

Chief Investment Officer

If Congress does not act, a debt limit showdown with a possible government shutdown looms on Friday, October 1. In addition, Treasury Secretary Yellen has warned that the Treasury will exhaust its cash and extraordinary measures in October if the debt ceiling is not lifted. Unless the debt ceiling is increased, the U.S. cannot issue more debt. While a possible default on our U.S. debt will be discussed in the news if an agreement is not reached, a default is virtually certain not to happen. This debt ceiling argument is a political fight in which each side thinks it can extract something from the other.

According to Strategas Research Partners, the federal government collects about $4 trillion in revenue and has only $350 billion in interest costs. The federal government can fund defense, veterans, Medicare, Social Security, and health programs from cash flow alone. If the Democrats and Republicans cannot agree on terms to raise the debt ceiling, the federal government would eventually be forced to prioritize spending to avoid default and continue servicing the U.S. debt. In the end, Congress will raise the debt ceiling, but it may not happen before the government is forced to shut down for a period.

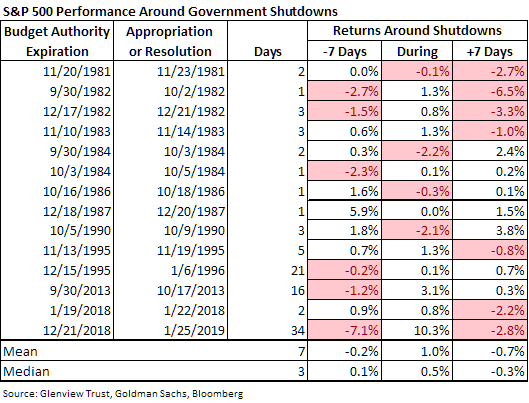

Typically, additional uncertainty does not benefit the performance of the stocks market, so it is instructive to look at past instances of government shutdowns. Interesting, the S&P 500 was usually higher on average during the past 14 government shutdowns since 1980. In fact, the most recent episode in 2019 had solid returns but was preceded by a seven percent sell-off. While the returns during the shutdown seem to be reasonably calm, there is some evidence of volatility around the shutdown period.

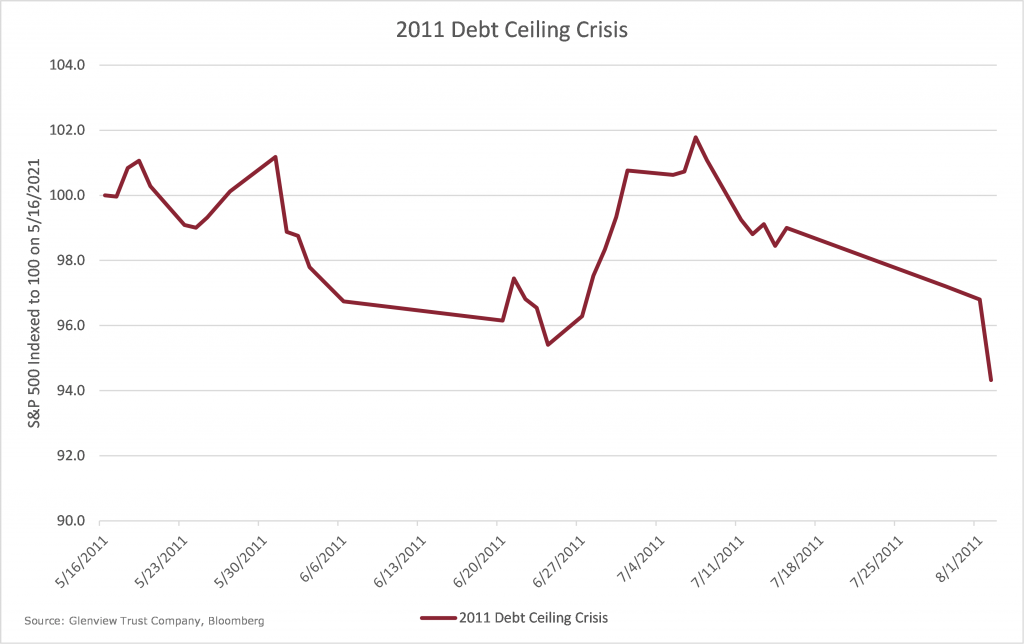

Recent debt ceiling crises leave a more mixed picture, however. In 2011, the U.S. began using extraordinary measures to service the debt on May 16, reaching an agreement on August 2. During that period, the S&P 500 fell almost -6%. It is unlikely that the debt ceiling was the only reason for the decline, as Europe was mired in a debt crisis, and economic growth was slowing.

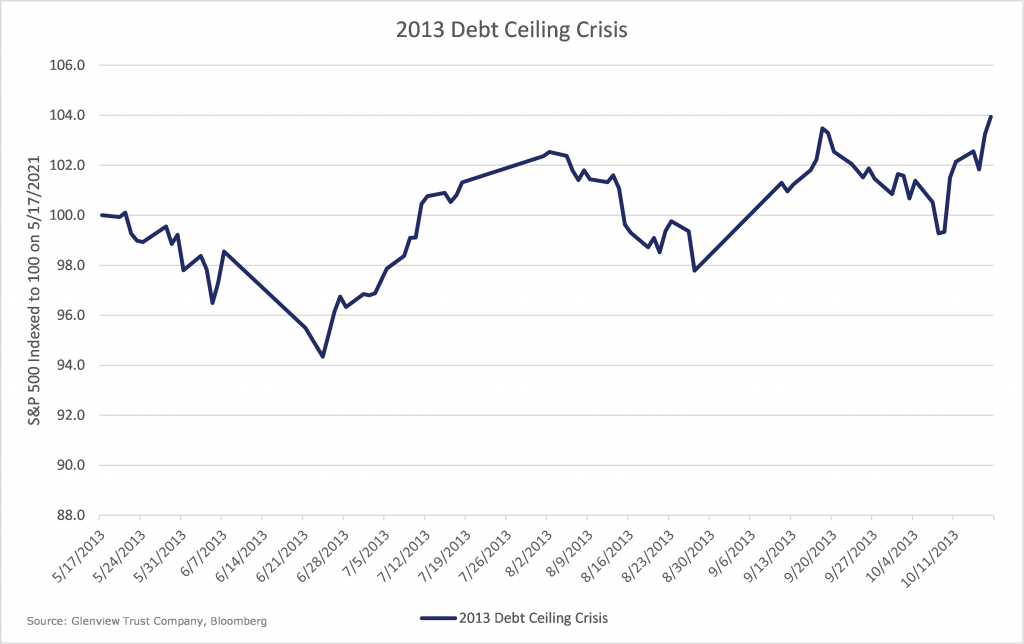

In 2013, extraordinary measures were started on May 13, and an agreement was reached on October 17. During this period, the S&P 500 was almost 4% higher though stocks were down nearly -6% at one point during the period.

Investors should be prepared for more stock volatility if Congress cannot reach an agreement to raise the debt ceiling this week and keep the federal government open. History provides no reason to sell stocks due to an impending debt ceiling showdown or government shutdown; instead, any declines driven by the conflict are likely to be an opportunity for investors looking to increase exposure. While much of the tax and spending bills will likely take until sometime in the fourth quarter to be completed, Congress will also continue to negotiate the hefty tax and spending bills.

Please do not hesitate to contact your Glenview team or me if you have any questions.

Disclosures

This publication is furnished for the use of The Glenview Trust Company and its clients and does not constitute the provision of investment or economic advice to any person. Persons reading this publication should consult with their investment advisor regarding the appropriateness of investing in any securities or adopting any investment strategies discussed or recommended in this publication. Statements regarding future prospects may not be realized. The information contained in this publication was obtained from sources deemed reliable. Such information is not guaranteed as to its accuracy, timeliness, or completeness by The Glenview Trust Company. The information contained in this publication and the opinions expressed herein are subject to change without notice. Past performance is no guarantee of future results. Neither the information in this publication nor any opinion expressed herein constitutes an offer to buy or sell, nor a recommendation to buy or sell, any security or financial instrument. ©2021 The Glenview Trust Company. ©Copyright The Glenview Trust Company. All rights reserved.