PERSPECTIVES

IN THIS ISSUE

Estate planning

Small business succession planning

What if you prefer to sell your business?

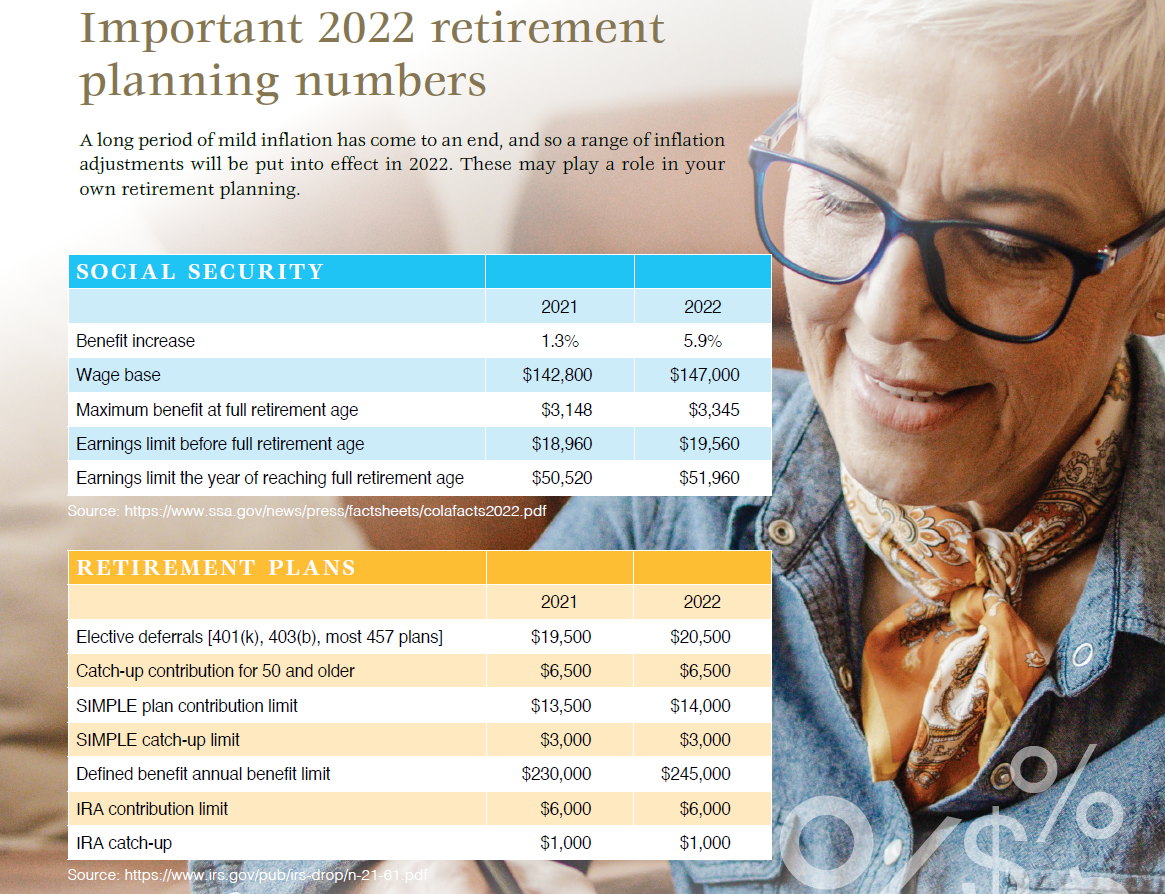

Retirement planning

Important 2022 retirement planning numbers

Philanthropy

Direct charitable gifts from an IRA

Estate Planning

Succession planning is more important than ever.

In an average year, about 600,000 establishments go out of business, according to the Federal Reserve. The advent of the pandemic was feared to boost that figure sharply, which led to Congress adopting the Paycheck Protection Plan. The legislation appears to have softened the blow of the pandemic on business, because as of last April there were only about 200,000 excess business closings, again according to Federal Reserve data. About 70,000 of those were units of major companies that did not themselves go out of business, and 130,000 were separate businesses. Personal services businesses were hardest hit.

The full effects of the pandemic continue to be felt, as in the severe supply chain disruptions across the economy. There could yet be more “excess” business closings. But even in normal times, many small businesses fail.

Sound succession planning must integrate business strategies with estate planning. Such planning often includes powerful emotional overtones and family issues that are not easy to resolve with ordinary business logic.

Leadership for the future

A typical succession plan will have three goals: find and motivate talented successor management, treat all children (including those who don’t participate in the business) equally—or fairly—and keep death taxes to a minimum. How can these potentially conflicting goals be reconciled?

Situation: A daughter is working hard in the family business and has the talent to take it over in a few years. Her brother, a busy doctor, likes to offer occasional suggestions but won’t materially participate in the business operations. The “business child” doesn’t want to build up the value of the business only to have to share that value equally with her brother after the parents die. A secondary problem is that the estate tax will be due on the full value of the business at the parents’ deaths, even though much of the value is attributable to the daughter’s efforts.

Possible solution: The daughter purchases a 50% interest in the business today, giving the parents an interest-bearing installment note. The note provides the parents with a retirement income; following their deaths, the note passes to the son. Thus, each child is treated equally.

The remaining 50% of the business can be given to the daughter, her husband and their two children. By regularly using the “annual exclusion” from the gift tax every year and splitting their gifts, the parents can give the daughter and her family most or all of her share of business equity with relatively little gift tax cost.

Estate tax result: The value of the business will be removed from the estate if the gifting program is complete before the parents’ death. The value of the note will be taxed, but this value will not increase over time, which effectively “freezes” the estate tax exposure.

Situation: Two sons work for the business, but they can’t get along. Someone needs to be made the boss, but the parents are afraid of the potential for an abuse of authority. If one son obtains control, he might adjust his salary and control the business so as to eliminate profits to share with his brother. On the other hand, a son with a minority interest might use lawsuits to challenge business decisions, which could paralyze and perhaps destroy the business itself.

Possible solution: This is an especially difficult problem, but the best result all around might be for the parents to give the entire business to one son and purchase a life insurance policy on their own lives to create a comparable inheritance for the other child. The child being forced out of the business should be the owner and beneficiary of the insurance to shield the proceeds from estate tax.

Situation: Two daughters will inherit a business as equal partners, and they get along just fine. However, the parents do not want any portion of the business ever to fall into the hands of a son-in-law—they don’t want the business to be vulnerable to a son-in-law’s creditors, or the business to be impacted by a future divorce.

Possible solution: Create a living trust to own the business, naming the parents as co-trustees and family members as beneficiaries. As long as they are alive, the parents will run the business as before. At their deaths, a corporate fiduciary (such as us) will take over, managing the shares for the benefit of both families.

Start now

These fictional thumbnails only scratch the surface of the possibilities in business succession planning. A sound plan typically will utilize the talents of lawyers, accountants and trust officers, and takes time to develop and implement.

We have worked closely with business owners and their professional advisors in developing succession plans. Our experience is at your service.

What if you prefer to sell your business?

Perhaps you don’t have family members to bring into the business. Maybe you’d rather simplify your estate and retirement planning by cashing out entirely. The Small Business Administration has prepared a guide to introduce you to the process and issues of a business sale:

(https://www.sba.gov/sites/default/files/files/PARTICIPANT_GUIDE_SELLING_SUCCESSION_PLANNING.pdf). Questions to consider before undertaking the sale:

Do you have a history of strong profits? A financially strong business has a lot to offer a new owner. If your business is struggling financially, the busness will not be as attractive to buyers. Sometimes a business does not even have a market value beyond the assets of the business.

Is the business in a location convenient to potential buyers? Location is important to many businesses. Some businesses can be easily moved, others cannot.

Are your assets in good shape? Having assets in good condition, with significant market value and remaining useful life, adds to your business’ value.

Do you have quality inventory and good supplier relationships? A prospective buyer wants to see quality (e.g., fresh) inventory and solid relationships with suppliers.

Do you have a solid customer base? A healthy list of returning customers makes your business more valuable and attractive.

Do you have a healthy balance sheet? A combination of good retained earnings and net worth, low debt, and collectible accounts receivable makes for an attractive business that is worth purchasing.

© 2021 M.A. Co. All rights reserved.

Retirement Planning

The Washington Post reported that for the period ending in September 2021, the number of retirements among workers age 65 to 69 rose 5%, based upon Bureau of Labor Statistics data. Yet the Social Security Administration reported that the number of workers starting their Social Security benefits fell by 5% during the same period. It was the largest annual drop in 20 years.

Apparently more and more people are retiring but delaying their benefits. The Post article suggests that several factors may contribute to the trend:

- federal stimulus checks and expanded unemployment benefits may have allowed retirees to meet financial obligations in the short term;

- pandemic-related restrictions at Social Security field offices around the country reduced access to in-person assistance in getting benefits started; and

- soaring stock market and home prices may have enabled more people to defer starting to receive their benefits.

Philanthropy

Direct charitable gifts from an IRA

A “charitable IRA rollover” is still available to those who have reached age 70½. Up to $100,000 may be transferred directly by the IRA custodian to the charity. When han-dled properly, there are two favorable tax consequences: The gift is not included in the donor’s taxable income, but it does count toward satisfying his or her required min-imum distribution (RMD) for the year. (The RMD rule doesn’t kick in until the owner is 72, but the charitable IRA rollover rule still uses the 70½ age.) Many retirees simply have directed their RMDs to charity.

The income tax exclusion for a transfer to charity from an IRA might not seem like such a big deal. After all, one always has been allowed to follow an IRA withdrawal by a charitable contribution and claim an income tax deduc-tion. But it is a big deal, because the full benefit of that deduction is not available to all taxpayers.

- Nonitemizers. Only an estimated 10% of all taxpayers still itemize their deductions. Retirees typically have lower incomes, and so are more likely to be using the standard deduction.

- Big donors. Percentage limits on the charitable deduction mean that some donors can’t take a full charitable deduction in the year that they make a gift. They can carry the deduction forward to future years, but the charitable IRA rollover is much better. There are no percentage limits (just the $100,000 cap), and the

excluded amount is not aggregated with other charitable gifts for the year in determining whether the percentage cap has been breached.

- Social Security recipients. An increase in taxable income may cause an increase in the tax on Social Security benefits for some taxpayers. The direct gift from an IRA avoids this problem.

Watch out!

A few caveats to keep in mind.

- The donor may not receive anything of value in exchange for the gift from the IRA. If something of value—even as little as $25—is received, the entire exclusion from income is lost.

- The gift must happen after the donor has reached age 70½, and not merely be made during the year the donor reaches that age.

- The exclusion is only available for direct charitable gifts from traditional and Roth IRAs, not from other tax-qualified retirement plans.

- Married couples may exclude up to $200,000 for direct gifts, but only if each spouse has an IRA as the source of the donation.

- Inherited IRAs may have RMDs for younger tax-payers. They don’t get the benefit of this charitable transfer rule. A charitable rollover may be made from an inherited IRA, but only if the beneficiary has reached age 70½.

Be sure to consult with your tax advisors before making any decisions that you might not be able to reverse.

Please do not hesitate to contact your dedicated Investment, Trust or Planning professional, if you have any questions.