Glenview Trust’s Bill Stone Talks Markets and Tesla Earnings On Cheddar News

What To Watch From The Fed And Earnings

Critical Takeaways From Bank Earnings

Critical Takeaways From Bank Earnings

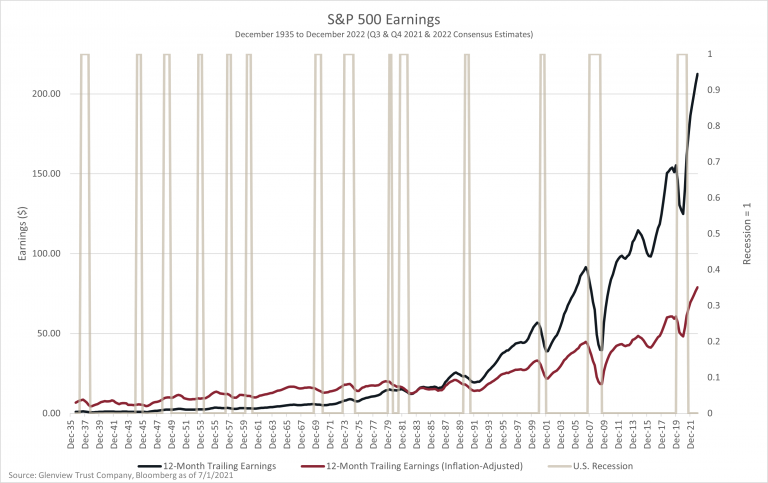

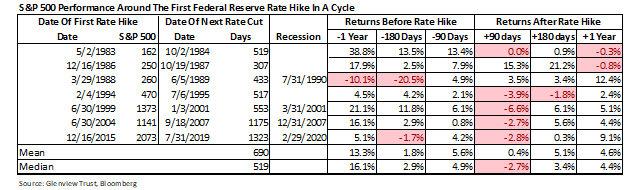

As expected, banks generally beat earnings estimates by a wide margin this quarter. The underlying metrics provide a more mixed picture, however. The recent weakness in banks could provide an opportunity for investors who believe economic growth is likely to continue.