Crucial Takeaways From Berkshire Hathaway’s 4Q Earnings And Buffett’s Letter

Berkshire Hathaway increased profit margins over 2020 and 2019 levels despite cost pressures. Operating earnings per share are now 24% above pre-pandemic 2019, benefiting from economic growth and share repurchases. Buffett’s annual letter took the form of an owner’s handbook for shareholders.

Glenview’s Stone Discusses Russian-Ukraine Tensions On Cheddar News

Should You Sell Stocks In Response To A Conflict In Ukraine?

Should You Sell Stocks In Response To A Conflict In Ukraine?

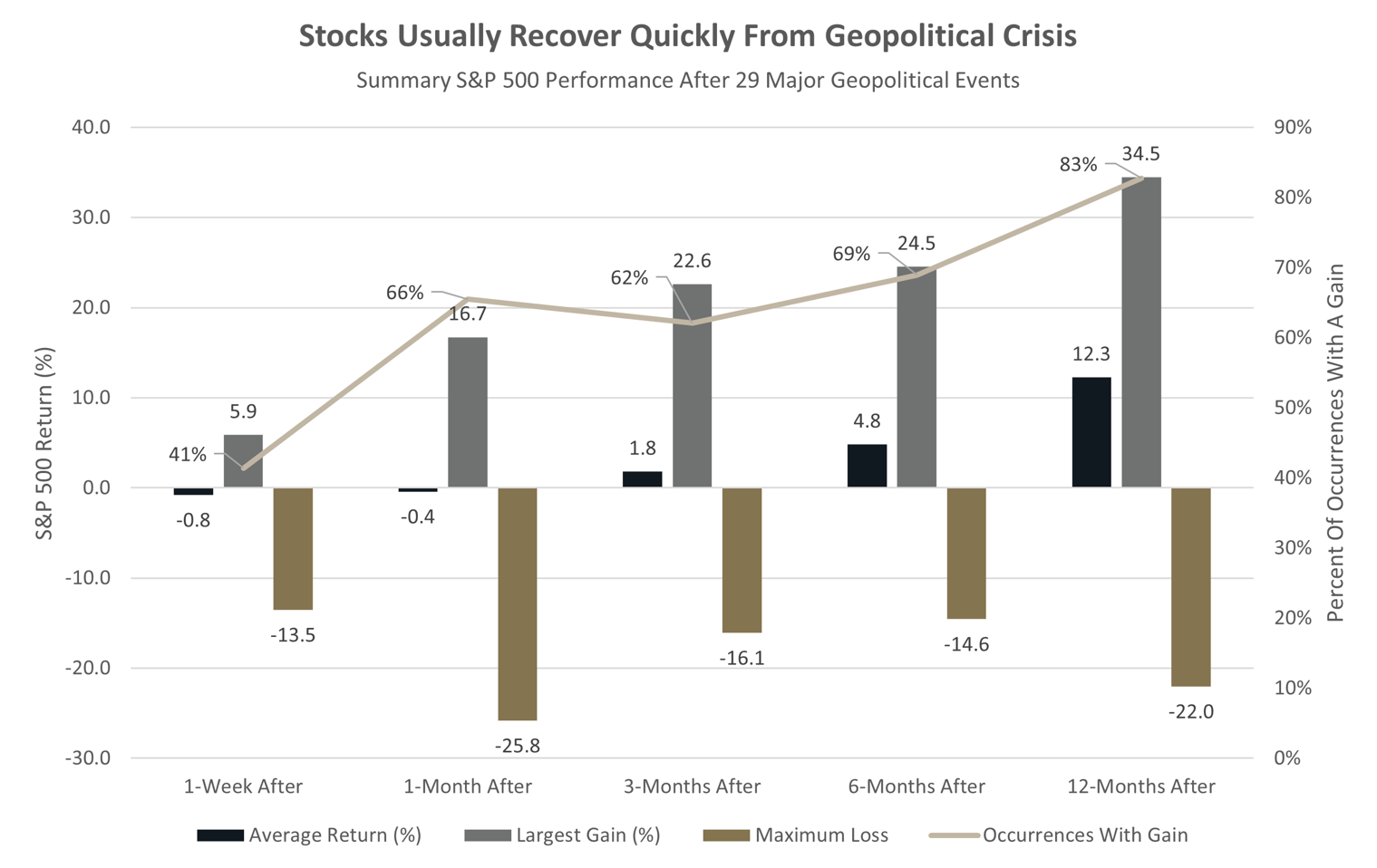

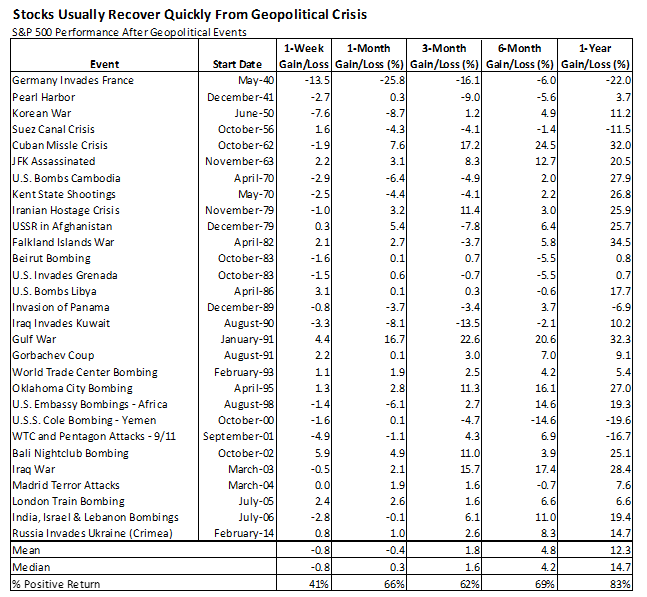

Stocks are nearing 10% off the high in response to rising tensions over Ukraine. Stock declines associated with geopolitical fears have generally been a temporary setback and an opportunity to buy at discounted prices. Investors should be prepared for volatility during these periods, though.

Geopolitical Events And Stocks

Berkshire Hathaway’s Portfolio Moves In The Fourth Quarter

Berkshire Hathaway’s Portfolio Moves In The Fourth Quarter

Berkshire’s $331 billion investment portfolio now consists of 44 companies and is very concentrated, with the top 5 holdings accounting for over 79% of the total portfolio. There were three new purchases, and Berkshire added to stakes in 4 companies.

Bad Inflation Outweighs Good Earnings

Bad Inflation Outweighs Good Earnings

Earnings results were encouraging, but inflation rose to a 40 year high of 7.5% year-over-year and spoiled the party. Markets are pricing in over six rate hikes from the Fed over the next 18 months. All the fundamental data could take a back seat to fears regarding the rising tensions over Ukraine.

Earnings Are Supportive Of Stocks But Misses Are Punished

Earnings Are Supportive Of Stocks But Misses Are Punished

Earnings results supported stocks despite some high-profile misses. Aside from earnings, a story that did not get enough attention is higher bond yields with the relative performance of bank stocks following the path of interest rates. Inflation should set a 40-year high this week.