PERSPECTIVES

IN THIS ISSUE

Estate planning

How to choose your trustee

If you’ve decided against a corporate fiduciary

Core advantages that we bring to the job of trusteeship

Retirement planning

Smaller RMD’s in 2022

Financial managment

“Buy, Borrow, Die”

Traditionally, the hot button for estate planning has been the reduction of federal and state death taxes. That tradition has been over for some time, given the increases in the amounts exempt from federal estate tax over the last decade. The 2021 federal exemption stands at $11.7 million, and married couples may double that with routine estate planning. (Note, however, that under current law the exemption falls roughly in half in 2026, unless Congress acts sooner.)

Freedom from estate and inheritance taxation doesn’t mean estate planning is no longer needed, it just means that planners will need to find a new hot button to motivate affluent people to take action. The larger exemption also does not mean that trusts won’t be useful in estate planning. A family trust established to provide professional asset management coupled with fiduciary supervision of trust distributions will, for many families, be as valuable today as it was when it did double duty, capturing the value of the federal estate tax exemption as well.

The advantages that trusts offer in sound wealth management may be squandered if one critical choice is not taken seriously. The decision that all too often gets short shrift is the choice of trustee.

Basic questions

The first step in trustee selection is to analyze the trust for which the trustee will take responsibility. The prospective trustee should ask these questions:

• What are the purposes of the trust?

• Who will be the beneficiaries of the trust?

• What are the dispositive provisions of the trust?

• How long will the trust last?

• What kinds of assets will be held in the trust?

• How large will the trust be?

There are some circumstances in which a trusted individual, even a family member, may be appropriate as trustee. For example, managing a shorter duration trust that holds uncomplicated assets may not be too difficult for someone to take on as an extra job. Larger trusts with longer expected durations will benefit from employing a corporate fiduciary, such as us. This is doubly true for trusts that have competing beneficiaries, whose interests may at times clash, because fiduciary judgment will come into play.

Qualifications

Next, consider the specific characteristics that good trustees should have.

Experience and expertise. The more that a trustee can do, the less need there will be to engage outside experts.

Free of conflict of interest. In general, the trustee should not be a beneficiary, nor should the trustee have an economic stake in the trust assets.

Permanence. The age and health of a proposed trustee must be taken into consideration, unless one is choosing a corporate fiduciary.

Location. Close geographic proximity to the beneficiaries is not required, but it can be helpful in trust administration.

Payment. Trust administration is not expensive, as investment services go, but neither is it free. The trustee should expect to be compensated.

Accountability. Should there be trust maladministration of some sort, can the trust and the beneficiaries be made whole? The answer is “yes” with a corporate fiduciary, but with an individual trustee, in many cases, the answer could be “no.”

May we tell you more?

We are well qualified for all the tasks of trusteeship. It is a job that we do every day, with our full attention. We are staffed for it, experienced, and always ready to serve.

When you are ready to take the serious step of including a trust in your long-term financial and wealth management plans, please call upon us to learn more about how we may be of service to you. We look forward to answering all of your questions.

Eventually, the tax preferences for retirements savings come to an end. It happens slowly, over the end of one’s life, through periodic required minimum distributions (RMDs) geared to one’s life expectancy.

Two big changes have occurred for RMDs recently. The more important one is that they don’t begin until the year one reaches age 72 (formerly the age was 70 ½). The second is that the IRS has updated the actuarial tables for RMDs to reflect our increasing lifespans.

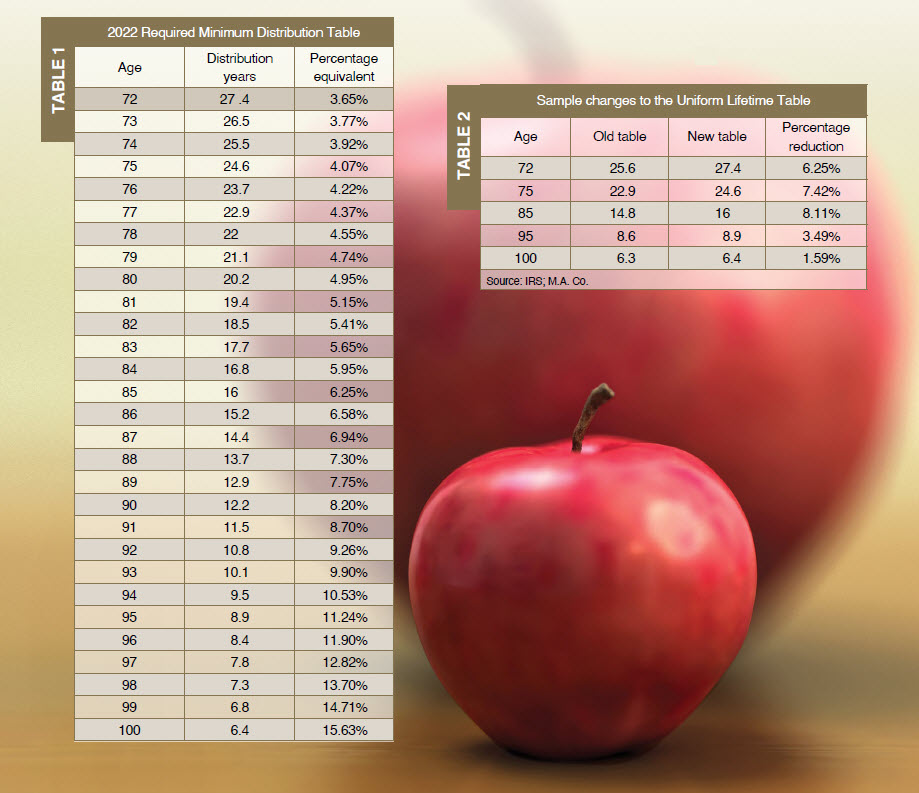

Table 1 below is based upon the IRS’ Uniform Lifetime Table for 2022 RMDs. The first column is the age of the taxpayer, the second is the life expectancy at that age, and the third is a percentage equivalent of the life expectancy. As you can see, when a retiree is in his or her 70s it is quite possible that the RMD will be less than the income generated by the retirement savings.

Table 2 compares the factors in the old and new tables for some sample ages. The percentage reduction in the RMD is shown also. Some observations:

- The factor for the first RMD was 27.4 at age 70 in the old table, and it will be 27.4 at age 72 in the new table, a coincidence.

- The RMD from a $1 million IRA at age 75 was $43,668 under the old table, and will be $40,650 under the new table.

- Assume a steady 4% total return on a $1 million IRA, with RMDs paid at the end of each year. Under the old table, total RMDs paid through age 100 from a $1 million IRA would have come to $1.69 million, and there would be $295,750 left in the account. Under the new table there will be two fewer RMDs by age 100. Total RMDs come to $1.62 million, and there will be $333,858 left in the account.

- Under the new table, if the rate of return is boosted to a steady 6%, the RMDs will be paid from income for much longer, the IRA will have an extended period of tax-deferred growth. That $1 million IRA would pay some $2.23 million in total RMDs through age 100, with $606,255 remaining in the account.

The purpose of these changes to RMD rules is to make it less likely that retirees will outlive their money. The RMD is only a minimum; there is no cap on distributions from an IRA during retirement.

Financial Management

“Buy, Borrow, Die”

The Wall Street Journal reports a boom in borrowing against securities portfolios (margin loans), especially by the wealthy [Buy, Borrow, Die: How Rich Americans Live Off Their Paper Wealth, July 13, 2021]. Such loans offer an easy way to take advantage of stock market gains without incurring income taxes on the capital appreciation. What’s more, today’s low interest rates make such loans very attractive from a financial planning perspective. Loan proceeds may be used for additional investments, adding leverage to the portfolio, but the Journal reports they are also being used to pay for vacations or other major purchases.

Unlike home mortgage interest, there is no dollar cap on the deduction for interest paid on margin loans when the proceeds are used to invest in securities. Rather, the limit is set by the amount of the taxpayer’s investment income and is subject to certain exceptions. When the proceeds of the borrowing are used for personal use items (vacations, automobiles, boats) the interest is generally not deductible.

The more important tax break in this arrangement is that appreciated assets that are held until death get a tax-free step-up in basis to fair market value, which can lead to the strategy of “buy, borrow, die.” When the basis step-up rule was created, the tax forgiveness was offset by the imposition of the federal estate tax at fairly high rates. With today’s much higher federal exemption from the federal estate tax, most families can forget about estate taxes entirely and focus instead on managing taxes on their long-term gains.

The Biden administration has proposed a major change to this calculus. The proposal calls for reating the transfer of appreciated assets at death as a realization event, requiring the recognition of capital gain and

treating the transfer of appreciated assets at death as a realization event, requiring the recognition of capital gain and the payment of associated taxes. The exemption for such taxes would be limited to $1 million per taxpayer. In addition, the proposal calls for treating a lifetime gift of appreciated property the same way. Under current law, gifts get no basis step-up, but the tax on capital gains may be deferred indefinitely simply by never selling the asset.

Such a change in the tax law would reduce tax benefits but not eliminate the attractiveness of the strategy. It would have the potential of raising more revenue than the federal estate and gift tax bring in currently to the IRS. Whether the idea will gain traction in the Congress is presently uncertain.

© 2021M.A. Co. All rights reserved.

Please do not hesitate to contact your dedicated Investment, Trust or Planning professional, if you have any questions.