Roth 401K or Traditional 401k? What You Need to Know

Does everyone dread selecting annual benefits? Benefits are nice to receive, but making choices can be a little daunting. This article focuses on which commonly offered retirement savings vehicle to choose.

Deciding between contributing to a Roth 401K and a Traditional 401K (or Pre-Tax 401K) involves weighing your current financial situation against your expectations for retirement, primarily regarding your income tax bracket. Both plans allow your investments to grow without current taxation of the income. The IRS places annual limits on the amount you may contribute to both types of plans. By contributing some to either or some to both, you will most likely be eligible to receive a contribution from your employer. If you don’t participate, you could forfeit potential additional savings from your employer. Furthermore, some employers allow you to direct their contribution to be invested in the alternative to the choice you make with your own contributions. Inquire about this before making your decision.

Here’s a reference to help you make an informed decision:

| Roth 401K | Traditional 401K | |

| Contributions | Made with after-tax dollars (no current benefit) | Made with pre-tax dollars (reduces your taxable income when contributing) |

| Withdrawals | Qualified withdrawals are tax free | Every dollar distributed is taxable. Penalties may apply to withdrawals made before age 591/2 |

| Best for individuals who… | Believe they will be in a higher tax bracket in retirement. | Anticipate being in a lower tax bracket in retirement than they are currently. |

| Income Limits on contributions | None | None |

| Required Distributions | None during lifetime. | Required Minimum Distributions (RMDs): You generally must start taking withdrawals when you reach age 73 (born 1951-1959) or age 75 (born 1960 or later) |

**Please note that IRAs have different rules than 401Ks**

Generally speaking, younger individuals may benefit more from a Roth 401K as they may be in a lower tax bracket now and have a longer time for their investments to grow tax-free.

If you anticipate a lower tax bracket in retirement and you are at the height of your earning potential, a traditional 401K could be a better choice as it offers a current reduction in taxable income.

How much impact does this choice have on my current paycheck? Here’s an example:

| Roth 401K | Pre-Tax or Traditional 401K | |

| $100,000 Gross Salary, 26 pay periods | $3,846 | $3,846 |

| 10% 401K Contribution | -$385 | |

| Wage Base | $3,846 | $3,461 |

| 10% 401K Contribution | -$385 | |

| FICA & MC 7.65% of Gross | -$294 | -$294 |

| Local, 2.2% of Gross | -$85 | -$85 |

| FED & State, 19% of Base | -$731 | -$658 |

| Net take home pay | $2,351 | $2,424 |

The example above is hypothetical, for illustration only. No individuals will have the same results based upon benefits and elections.

While there isn’t a huge variance between take-home pay in the illustration above, by contributing to the Pre-Tax or Traditional 401K, the hypothetical employee reduces annual taxable income by more than $10,000. The more you save, the more you will reduce taxable income when contributing to a Pre-Tax or Traditional 401K.

If your employer’s plan permits, it’s often possible to contribute to both a traditional 401K and a Roth 401K, as long as the combined contributions don’t exceed the annual maximum allowed by the IRS. Additionally, some plans permit employees to contribute to the Traditional 401K (for the immediate tax break) and designate the employer portion to be contributed to a Roth 401K. This may be attractive to employees who want a current tax benefit from their contributions but also wish to build a fund that will be tax-free in the future. Keep in mind, however, if your employer makes contributions to a Roth 401K, they are considered taxable income in the year they’re made. Employer contributions to a Pre-Tax/Traditional 401K are not currently taxable income to the employee, but will be taxable when withdrawn in retirement.

TAKEAWAYS

- Whether you choose to save for retirement in a Roth 401K or a Traditional 401K, save at least enough to maximize your receipt of employer contributions.

- If you don’t know if your income will be higher in retirement than now, your Glenview Planning Professional can help.

- Traditional 401K contributions reduce taxable income now but will be taxable when withdrawn.

- Roth 401K contributions do not reduce taxable income now but will be tax-free when withdrawn during retirement.

- Finally, the most important takeaway is to start saving early in your career so that you will benefit from years of contributions and growth of your investments.

Reading The Tea Leaves: Implications Of Fed Chair Powell’s Speech

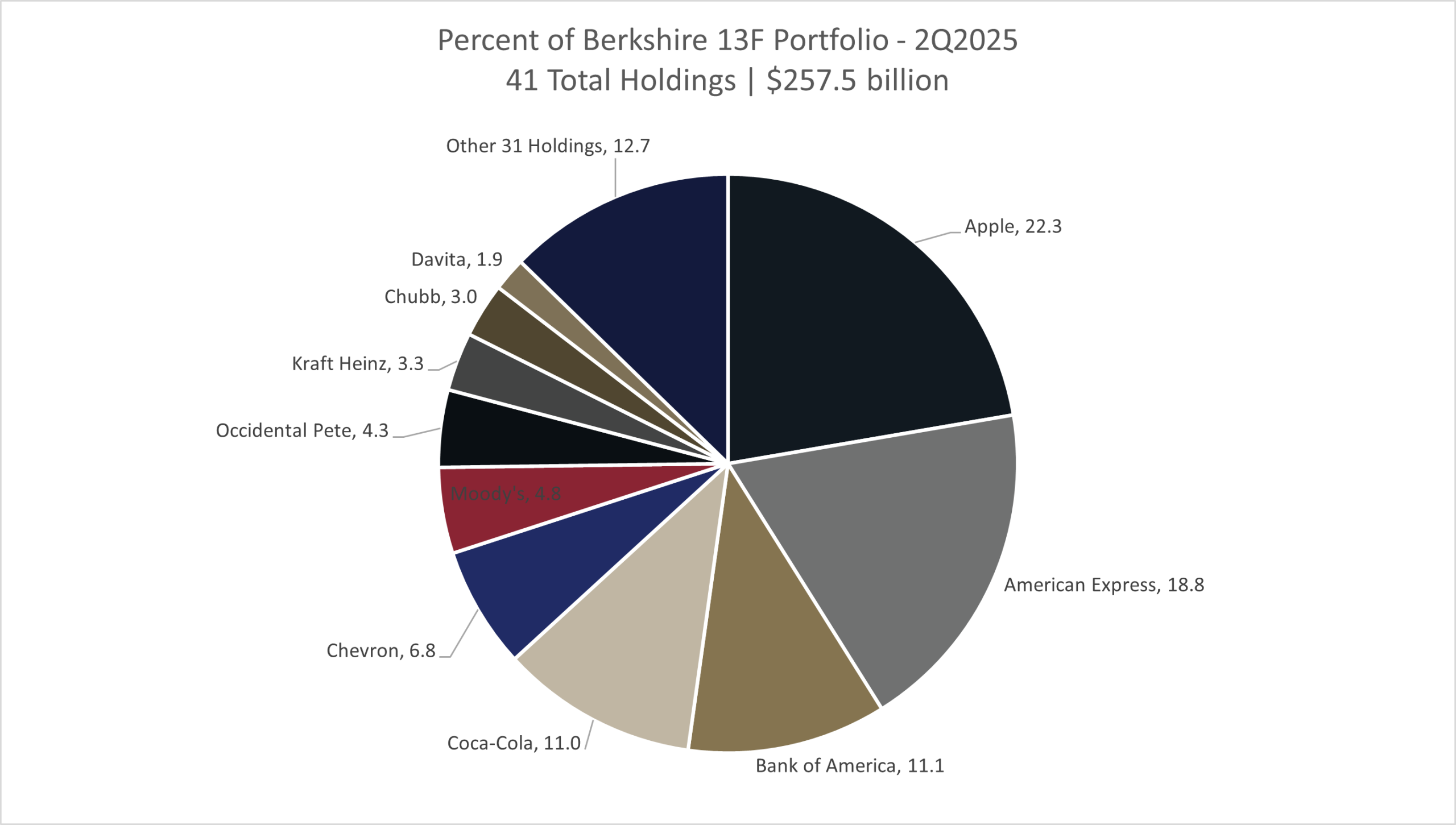

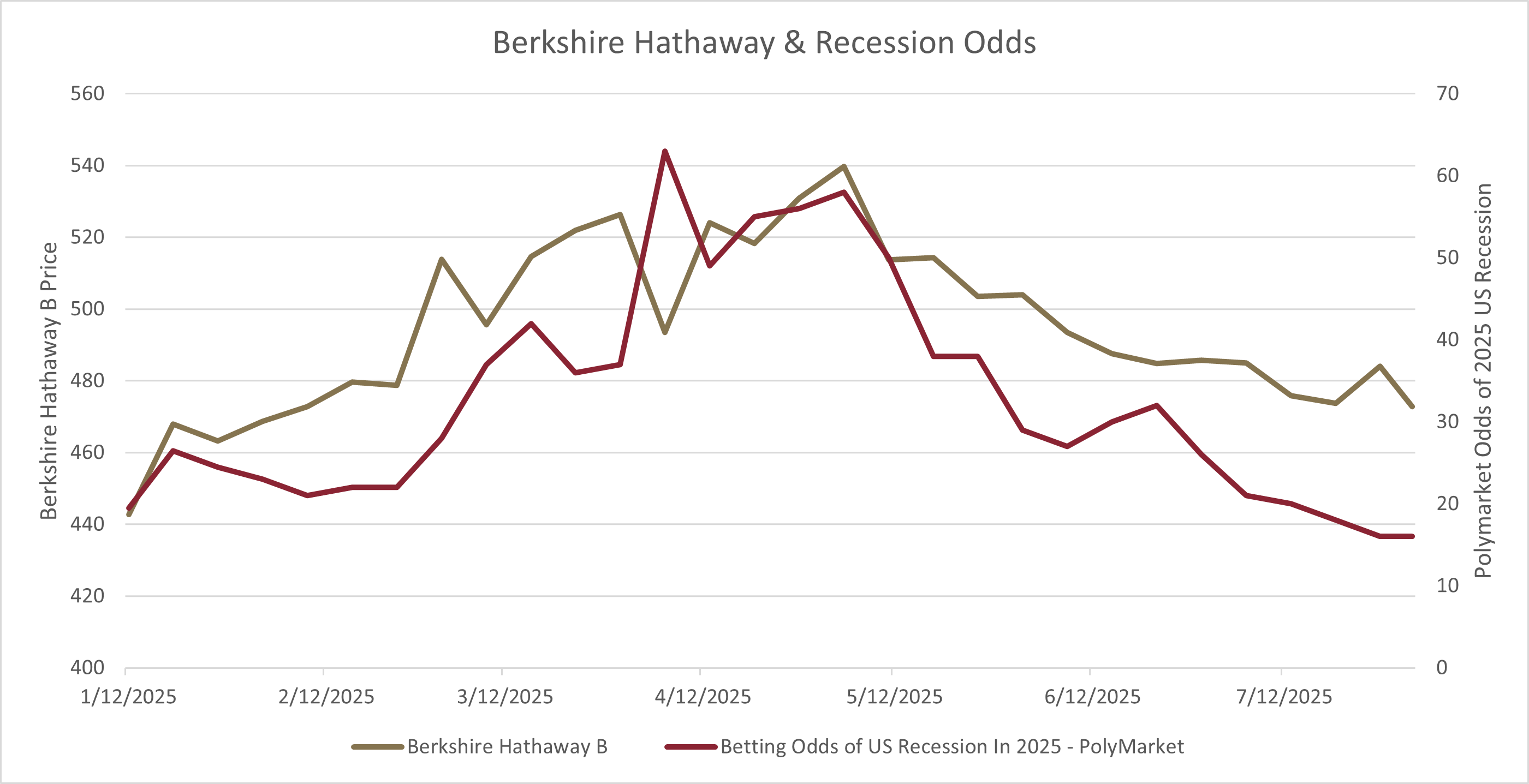

Berkshire Hathaway’s Second Quarter 2025 Portfolio Moves

HOW TO AVOID THE DRAMA SURROUNDING JIMMY BUFFETT’S ESTATE PLAN

YOU GOT FINS TO THE LEFT, FINS TO THE RIGHT

AND

YOU ARE THE ONLY GIRL IN TOWN

Jimmy Buffett (“Jimmy”) seemingly had his estate all wrapped up in a few neat packages before he died, but now, less than 2 years after his death, his estate plan has become fodder for tabloid headlines and a source of distress for his wife Jane. Jimmy drafted his estate plan (including a pour-over Last Will and Testament (“Will”) and Declaration of Trust (“Trust”) in the early 1990’s and amended them in 2017 and 2023 shortly before he passed away in September 2023. In the Trust, Jimmy set up a Marital Trust for his wife Jane (married in 1977) to provide for her during her lifetime. Upon Jane’s death, the Marital Trust is to be distributed to their three children, Savannah, Delaney, and Cameron (with a retained power of appointment to Jane over the assets). The Trust also established separate trusts for each child ($2MM each, utilizing the remainder of Jimmy’s estate tax exemption). The use of a Marital Trust is a common technique used by estate planners to defer estate tax that would otherwise be due at the first spouse’s death until the death of the second spouse (tax on excess assets over applicable estate tax exemption available to the first spouse).

Jimmy’s estate consisted of his musical catalog with ongoing royalties (estimated at $20MM annually), numerous parcels of real estate, airplanes, an investment portfolio, as well as a 20% interest in Margaritaville Holdings, LLC, a lifestyle brand-company that he and Jane founded in the 1990’s. Margaritaville Holdings owns over 30 restaurants, 20 hotels, along with vacation clubs, retail stores, casinos, and cruise ships. All in, the estate is likely worth north of $275MM—with the assets described above (other than several family properties which were supposed to be distributed outright to Jane) now being held as assets of the Marital Trust.

The terms of the Marital Trust provide that Jane is to receive the net income and principal distributions for health, maintenance, and support, and for any other purpose that the independent trustee deems to be worthwhile and in the best interests of Jane. Also, the Marital Trust cannot retain non-income-producing property/assets without the consent of Jane. Jimmy named his wife Jane and Richard Mozenter (“Richard”), a friend and business advisor, as co-trustees of the Marital Trust, with Richard named as an independent trustee.

Troubles soon began. Jane was concerned, as any surviving spouse would be, over projected income and expense flows, whether she would have sufficient assets to maintain the lifestyle that she had enjoyed with Jimmy, and what her future held for her. To that end, she requested financial and business information from her co-trustee on cash-flow projections, what assets were actually part of the Marital Trust corpus, whether certain assets were worth retaining or should be sold (or whether they should have under the terms of the Marital Trust been transferred directly to Jane), whether assets were producing income as required under the terms of the Marital Trust, and what fees were being charged by Richard and his firm to the Marital Trust. According to Jane, Richard was not forthcoming with the requested information. Richard filed a petition in Palm Beach County, Florida on June 2, 2025, to have Jane removed as co-trustee of the Marital Trust. Jane countersued in Los Angeles County, California, to have Richard removed as co-trustee on June 3, 2025.

Richard’s petition alleged that (a) Jane failed to cooperate in managing the Marital Trust assets and was very angry and hostile in her dealings with him, (b) Jimmy had expressed his concern over Jane’s ability to manage and control the Trust assets—hence the appointment of an independent trustee, (c) Jane failed to act as a co-trustee, only acted in her own beneficial interest, and (d) Jane failed to cooperate which caused harm to the Marital Trust as Richard had to fire 35 employees, sell several airplanes, boats and real estate as well as oversee several business and financial matters that Jane should have undertaken.

Jane’s petition alleged that (a) Richard failed to timely communicate with her regarding the assets contained in the Marital Trust, the projected cash-flow from the Marital Trust assets, historical cash flow reports prior to Jimmy’s death as well as updates and/financial statements on Marital Trust activities; (b) when projections were finally provided, they showed approximately $2MM in net income on a Martial Trust valued at $275MM (a less than 1% return) and that although $14MM had been distributed out to the Marital Trust from Margaritaville Holdings since Jimmy’s death, none was included as being distributable to Jane; (c) Richard and his firm charged over $1.7MM in fees to the Marital Trust from September 2023 to February 2025; (d) the information finally provided was not detailed enough for Jane and her advisors to assess the reliability and completeness of the records and projections (updated projections and financial information were finally provided to Jane in May 2025); (e) Richard tried to transfer real estate that under the terms of the Marital Trust should have been transferred to Jane to the Marital Trust instead; and (f) Richard treated her with disrespect creating a hostile work environment. On July 21, 2025, Jane filed a counterclaim against Richard in Palm Beach County, Florida, requesting the Florida court to remove Richard as co-trustee for breach of fiduciary duty and wasting of trust assets, amongst other allegations.

There are lots of lessons to be learned from this unfortunate scenario playing out in LA and Palm Beach for you and your family as you think through your estate plan, or alternatively, if a family member or friend asks you to serve as a trustee in their estate plan, with the choice of trustee being front and center. In this instance, Jimmy chose his wife and long-time business advisor to act as co-trustees. There is no indication in the petitions that Richard had acted as a trustee in other matters, and it was clearly Jane’s first time. In many instances, especially in a situation like this one, choosing a professional corporate trustee would have made the most sense.

In Jimmy’s estate situation, the co-trustee relationship was likely doomed from the start. It is clear from the allegations in both petitions that neither Jane nor Richard understood their role as co-trustee. Jane was looking to Richard to do all the heavy lifting regarding trust administration. She seemed to treat the situation more like she was just a beneficiary of the Marital Trust. Richard, on the other hand, clearly did not understand his obligations to provide accurate, timely, and useful information regarding the assets in the Marital Trust and how they were being administered. He undertook changes in business operations and sales of assets and charged substantial fees for his firm without consultation with Jane as co-trustee. Richard’s role certainly could have been broader in terms of what his responsibilities were under the Marital Trust document, but those additional responsibilities, if any, were not discussed in any of the petitions.

Using a corporate trustee in Jimmy’s situation could have solved most of the issues we see laid out in the two very public petitions. A professional trustee understands the role of a trustee under state law and in interpreting estate planning documents that may alter statutory duties and responsibilities. A corporate trustee has accredited professionals trained to deal with trust and estate administration and has processes in place to provide timely, accurate and useful information to beneficiaries and other advisors as necessary. A corporate trustee is a genuine fiduciary whose sole interest is in managing the trust and its assets for the benefit and best interests of the beneficiaries, with a very low likelihood of any conflict of interest. In most instances, a corporate trustee will be a truly independent trustee, without the attendant baggage of past relationships or interactions. Finally, a corporate trustee will set forth its fee structure to act as trustee prior to taking on the role so that all parties are aware of the amount and under what circumstances a fee will be paid.

A better way to structure a situation similar to Jimmy’s would be to name a corporate trustee with Jane as a co-trustee (or advisor to the Marital Trust) and Richard designated as a business advisor to maintain continuity of advice, client history, and management of the underlying assets. A trustee can hire additional attorneys, accountants, real estate specialists, and business advisors as needed to provide a full range of advice and management of various types of underlying assets that were at play while keeping the decision-making process with just one entity regarding roles, responsibilities, and compensation paid to each. At Glenview Trust Company, we review your existing estate plan and, after our review, provide you with an analysis of whether you and your family would benefit from using a corporate trustee as well as what provisions in your plan might need to be revised to make sure your estate doesn’t end up in the tabloids. Clear communication among the settlor, trustee(s), and beneficiaries (while the settlor is still alive) regarding roles, responsibilities, and expectations is essential to make sure the transition is smooth. Remember, without proper planning and implementation, waiting “Just behind the reef are the big white teeth of the sharks that can swim on the land” and they will make everyone’s life miserable!