Closing time, one last call for alcohol

So, finish your whiskey or beer

Closing time, you don’t have to go home

But you can’t stay here

-Semisonic Paraphrasing Fed Chair William McChesney Martin, Jr.

Bill Stone

Chief Investment Officer

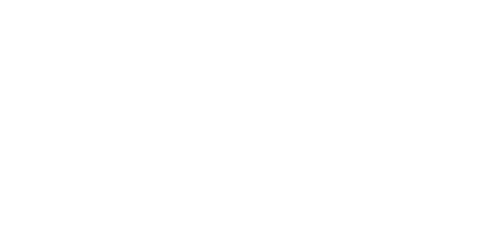

The second quarter of 2021 will likely mark the peak year-over-year growth rate on several measures, and markets have begun to reflect this reality. In addition, the Federal Reserve should start to remove stimulus later this year as the economy and job market heals. After the first quarter was a rout in favor of the more economically exposed value and dividend stocks, the second quarter was a more mixed picture with the growth stocks back on top of the heap (Chart 1). However, value and dividend stocks retained the crown for performance year-to-date

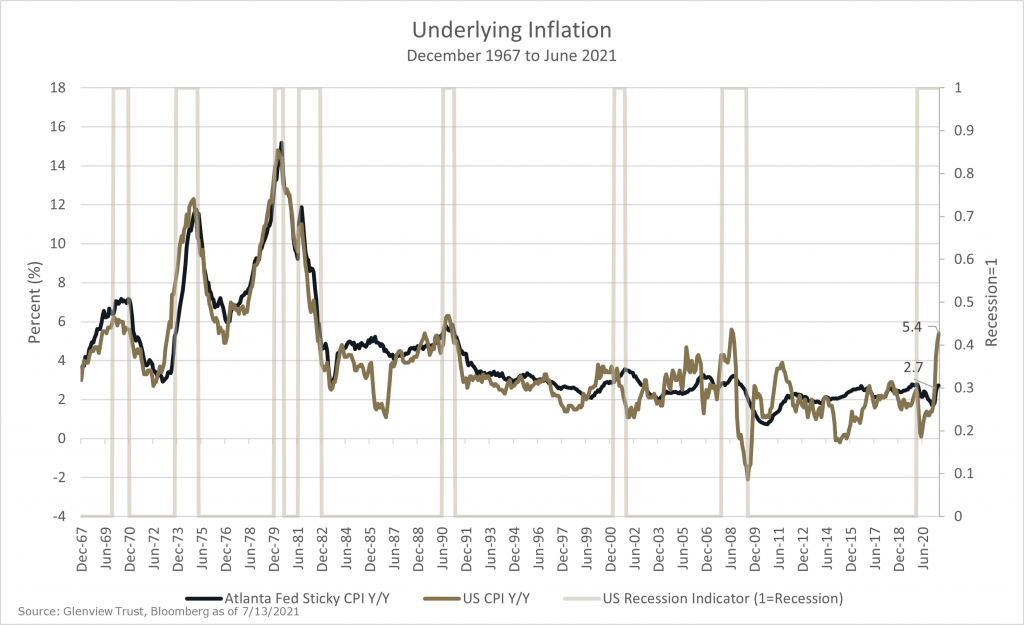

Economic growth has likely peaked for this cycle on a year-over-year basis, with GDP expected to grow at an over 12% pace once second-quarter data is released. In addition, April 2020 was officially declared the last month of the economic recession, making it the shortest downturn on record at two months. Last but not least, U.S. economic output in the second quarter as measured by GDP is almost sure to exceed the pre-Covid peak. While the rate of change in economic growth should slow, Bloomberg consensus GDP growth estimates remain at robust levels at 6.6% in 2021 and 4.1% in 2022.

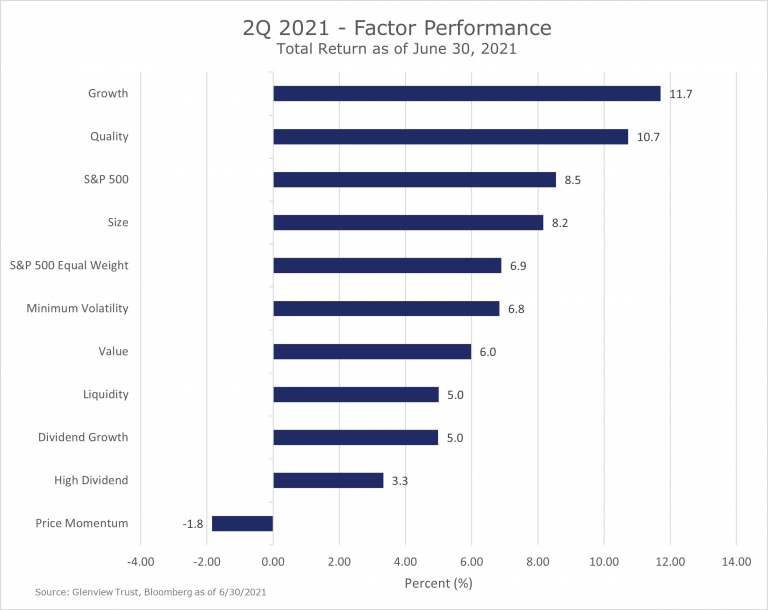

The good news is that consumer inflation (CPI) hopefully reached its year-over-year peak in the second quarter as well. June CPI readings were 5.4% year-over-year, but at least some of that increase is attributable to Covid-impacts and other transitory factors. For example, May car rental prices were almost 88% higher year-over-year, which will ease as these companies increase their fleets. Inflation remains elevated, though around a 3% annualized rate is a good approximation for underlying inflation in our view (Chart 2). There are good reasons to believe that inflation does not get out of control. Two strong arguments are the disinflationary impulse of technology and the recent increase in productivity, with second-quarter GDP expected to exceed the prior peak. At the same time, jobs are still almost seven million lower than the pre-pandemic peak (Chart 3).

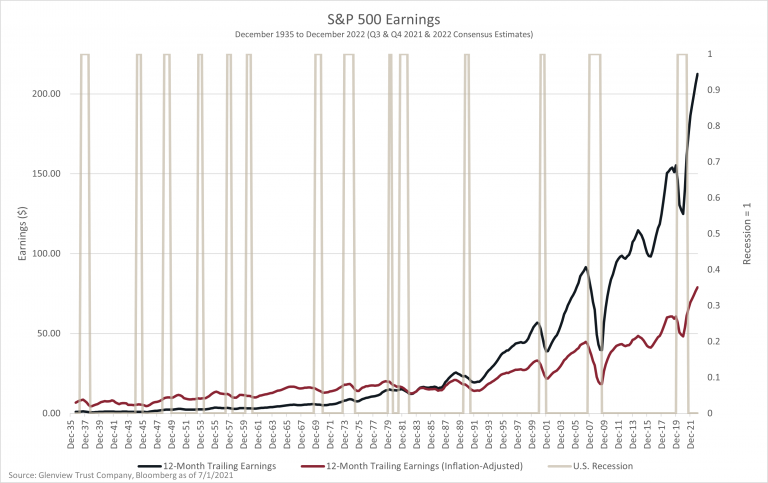

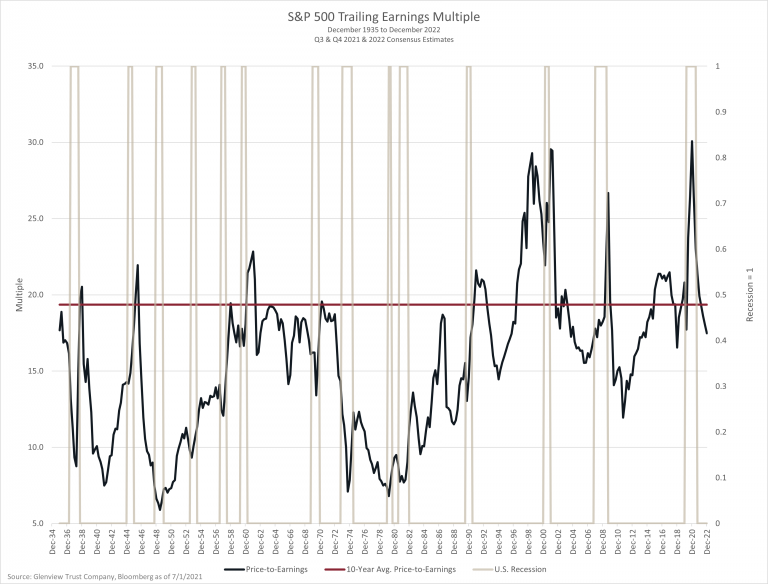

Year-over-year growth in corporate earnings is almost certain to peak in the second quarter, with the second quarter 2020 trough in profits due to Covid. According to FactSet, consensus earnings and sales growth estimates for the second quarter were 63.6% and 19.6% year-over-over at the end of June. While this might be the peak rate, earnings are still expected to grow by 35.5% in 2021 and 11.4% in 2022 (Chart 4). This increase in profits is expected to bring stock valuations below their ten-year average (Chart 5).

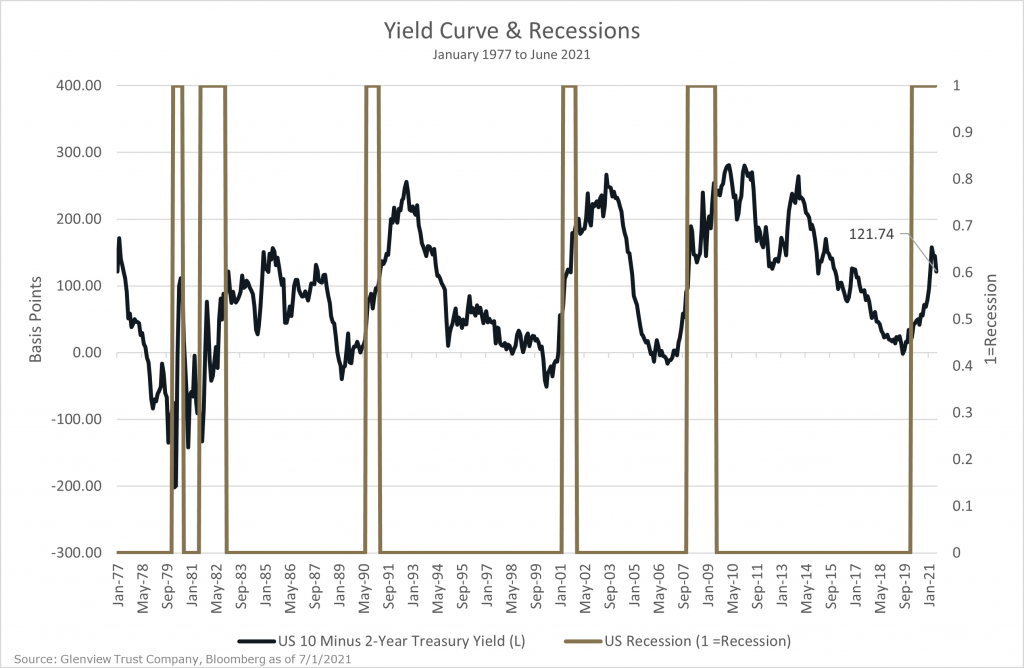

The Federal Reserve is also nearing peak stimulus to the economy. As stated by past Fed Chair William McChesney Martin, Jr., the Fed typically acts as “the chaperone who has ordered the punch bowl removed just when the party was really warming up.” The debate about how quickly the Fed will reduce asset purchases, also known as tapering, and begin rate hikes has impacted the markets recently. The worry is that the Fed could remove accommodation too quickly and smother the economic recovery. This concern, combined with fears about Covid variants, has affected economically sensitive stocks like value and cyclical stocks and sent yields on longer-term bonds lower. The yield curve, which has accurately predicted most recessions when the yield on the 10-year Treasury has fallen below the 2-year, reflects these trepidations (Chart 6). The difference in these yields was 1.22% at the end of June but has narrowed to 1.12% on July 14.

Currently, our forecast is for tapering to be announced in the fourth quarter and begin in late-2021 or early 2022. Interest rate hikes in late-2022 or early-2023 should follow the reduction in asset purchases. Markets indicate some concern that the Federal Reserve could raise rates too aggressively and snuff out the robust economic growth. This worry, combined with fears of a negative impact from the Covid variants, has driven the U.S. 10-year Treasury yield below 1.4% recently despite the relatively high level of inflation.

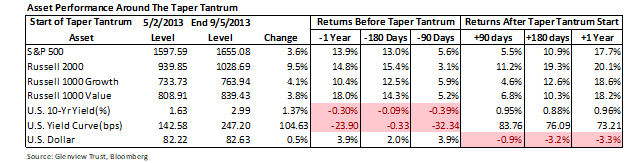

In the U.S., there has been only one other tapering process in the period following the global financial crisis. It was dubbed the “taper tantrum” since bond yields almost doubled in four months in 2013. Notably, this reaction beginning in May 2013 happened while tapering was being discussed, but the official policy decision to start reducing purchases did not come until December 2013. Since there is only one instance, one should be careful not to draw too many conclusions about the market impact of the upcoming taper from the past (Table 1). However, it should be expected that markets will move in advance of any official announcement. In addition, the reduction of asset purchases is not necessarily harmful to stock returns.

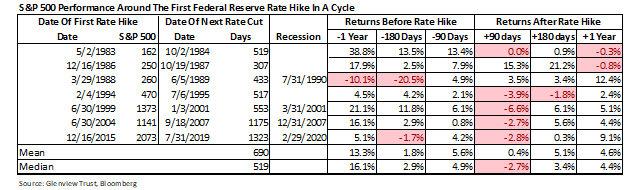

Despite the Fed’s history

of sometimes raising interest rates too vigorously and helping push the economy

into recession, stock returns before and after the first rate hike are

generally positive (Table 2). There does often seem to be some indigestion in the

three months following the first hike, though. As noted, it is probably more

than a year before the first rate hike at this point

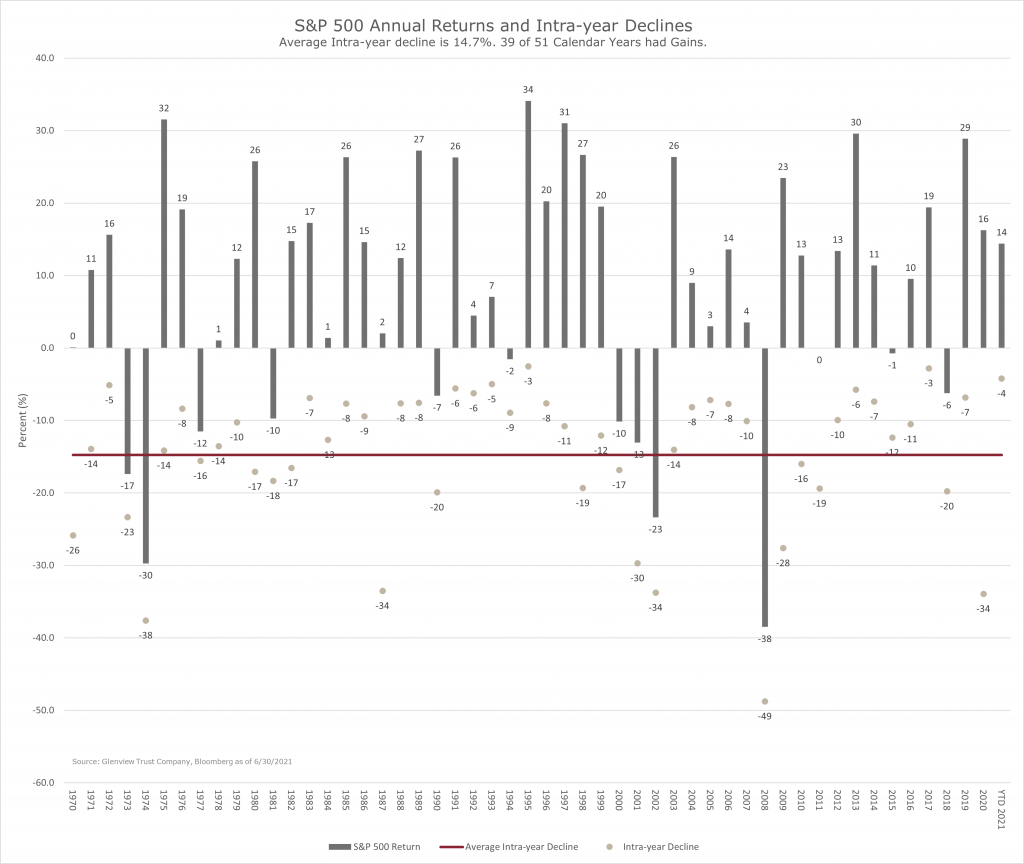

Our view is that investors should remain cautiously optimistic about stocks given the solid earnings outlook but remain aware of the current crosscurrents. In addition, the S&P 500 was over 14% higher in the first half of 2021, while only having an intra-year decline of 4% versus the long-term average of an almost 15% intra-year decline (Chart 7). As always, investors should work with their Glenview team to ensure their asset allocation provides the financial means to persist through any volatility.

Please do not hesitate to contact your Glenview team or me if you have any questions.