PERSPECTIVES

IN THIS ISSUE

Estate planning

Estate planning without taxes

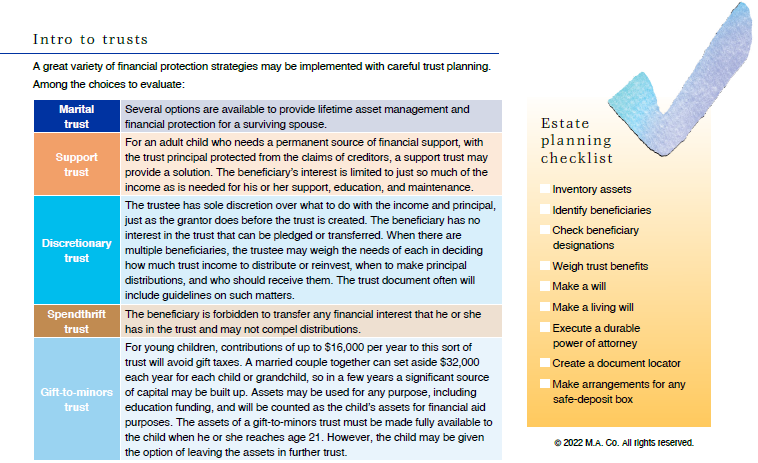

Intro to trusts

An avoidable tax disaster

A tax disaster avoided

Retirement planning

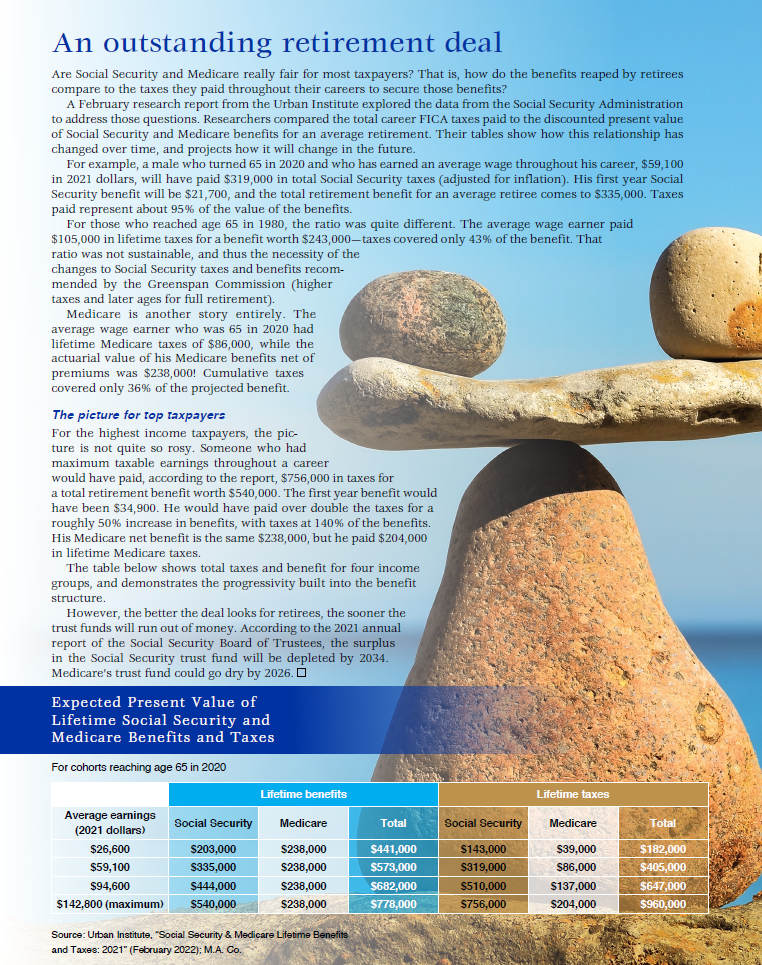

An outstanding retirement deal

March 2022

Estate planning without taxes

Put your beneficiaries first.

The traditional “hot button” that motivates people to see their lawyers about estate planning is taxation. Death taxes—inheritance taxes, estate taxes, federal taxes, state taxes—have taken a notorious toll on unplanned estates over the years. With sound planning, that burden can be lightened or even eliminated. In some cases, the tax savings easily cover the cost of the attorney’s fees for creating the estate plan.

However, that hot button has cooled considerably in recent years, as the federal estate tax has been increasingly targeted to larger estates. For example, a single person who dies in 2022 has an exemption from the federal estate tax of $12.06 million. A married couple, assuming that they both die in 2022, may shelter $24.12 million from federal estate tax, even without elaborate estate planning. An exemption that large would seem to let most families of moderate wealth off the hook. However, the exemption is scheduled to fall roughly in half on January 1, 2026. Some in Congress want to accelerate that change.

Even so, families with less than about $5 million in assets may be forgiven for feeling that they are no longer an estate tax target. However, there are other taxes to be considered at death. State inheritance and/or estate taxes typically kick in at lower wealth levels. There are income taxes to take into account, particularly income in respect of a decedent (primarily this affects retirement plan pay-outs after the death of the account holder).

But estate planning always has been about much more than tax planning. Estate planning always has been about financial protection for beneficiaries, with tax minimization just a means to that end. If you haven’t attended to your estate planning, don’t use the excuse of tax uncertainties to put it off any longer.

Evaluate

To begin, you have to know what you are working with.

- Inventory assets. Your estate plan will have to dispose of everything that you own; otherwise the state’s law of intestacy will apply. Bank accounts, stocks, bonds, real estate, and business interests, of course. Don’t overlook insurance policies and retirement plan bene-fits. You’ll need to know how as well as what—which property is owned jointly, which is owned outright.

- Identify beneficiaries. A surviving spouse and children are the usual persons to be protected. You may have more distant relatives to include, and you may want to remember some charities in your estate plan. Don’t overlook the need to care for your pets after your death.

- Check beneficiary designations. If you have an IRA or an employer-provided retirement plan, you already started on your estate planning when you made your beneficiary designations. These designations should be reviewed periodically, especially when there have been changes in family circumstances, such as a divorce.

- Weigh trust benefits. Trusts offer a wide range of financial benefits, especially valuable when beneficiaries need help with money management. Trusts may be established and funded during life (the living trust) or in a will (the testamentary trust). See “Intro to trusts” below for more information.

Implement

The next steps require the advice of an attorney and the execution of legal documents.

- Make a will. Your will contains instructions for the disposition of your property. It also nominates an executor or personal representative to manage the settlement of your estate.

- Make a living will. This document addresses your expectations for medical care at the end of your life. You also may want to execute a power of attorney for health care to identify an individual to make medical decisions on your behalf.

- Execute a durable power of attorney. Identify an individual who can make financial decisions on your behalf.

- Create a document locator. Your family needs to know where your will and powers of attorney are kept. Your executor will need to know the location of all your other important papers, such as tax returns, account statements, property deeds, and insurance policies.

- Make arrangements for any safe-deposit box. Very often a safe-deposit box is closed upon death and cannot be opened until probate. That makes it a poor choice for keeping documents that will be important at death.

These steps are not complete; they are simply suggestive of the ranges of issues that you will need to address in your estate planning.

Our invitation

We specialize in trusteeship and estate settlement. We are advocates for trust-based wealth management strategies. If you would like a “sec-ond opinion” about your estate plan-ning, or if you have questions about how trusts work and whether a trust might be right for you, turn to us. We’ll be happy to tell you more.

An avoidable tax disaster

Parent named an irrevocable trust as the beneficiary of his IRA, designated IRA X in a recent private letter ruling from the IRS. His children were the beneficiaries and trustees of the trust.

Soon after Parent died, the children were advised by the custodian of IRA X that they could not trade stocks in that account, that a transfer to another account would be required for that to happen. The custodian is not identified in the ruling. The children, acting as trustees, moved substantially all the IRA money to a non-IRA account that allowed for trading stocks.

Several months passed, and perhaps someone noticed the looming tax problem. The children asked the IRS for permission to move the money back into an IRA to preserve their tax benefits.

Sorry, no, said the IRS. “The only permitted method of transferring assets from an inherited IRA to another inherited IRA is via a trustee-to-trustee transfer, which requires a direct transfer from one IRA to another IRA. Therefore, once the assets have been distributed from an inherited IRA, there is no permitted method of transferring them back into an IRA.”

That conclusion also means the entire transfer of funds to the non-IRA account is taxable to the trust in the year that the transfer occurred. Thus, the children have inadvertently accelerated the income tax on sub-stantially all of the inherited IRA assets.

A tax disaster is avoided

Decedent’s surviving spouse was not a U.S. citizen, and therefore a Qualified Domestic Trust (QDOT) was created for the spouse’s inheritance. Such a trust is required to secure the marital deduction from the fed-eral estate tax for bequests to noncitizen spouses. The Form 706 filed for Decedent’s estate properly elected to treat the trust as a QDOT.

Some time later, the surviving spouse did become a U.S. citizen. However, she did not know that her action triggered the requirement of a final Form 706-QDT, and so she never told the trustee about it. The trustee, being left in the dark, never filed the form either. But after the surviving spouse’s death, the trustee did learn of the citizenship change, and so asked for an extension of time to file the Form so that the trust is no longer subject to the federal estate tax that applies to QDOTs.

The IRS granted the trustee another 120 days to make the filing, holding that everyone had acted reasonably in these circumstances.