A Checkup On The Health Of The U.S. Consumer

To paraphrase Mark Twain, the rumors of the death of the consumer are greatly exaggerated. Data points to a shift in consumer spending themes rather than the end of the strength of the consumer. The employment report will be closely watched this week as jobs are crucial to the spending outlook.

Glenview’s Stone On The Impending Bear Market And Fed Policy

Should You Buy Stocks With An Impending Bear Market And Possible Recession?

Should You Buy Stocks With An Impending Bear Market And Possible Recession?

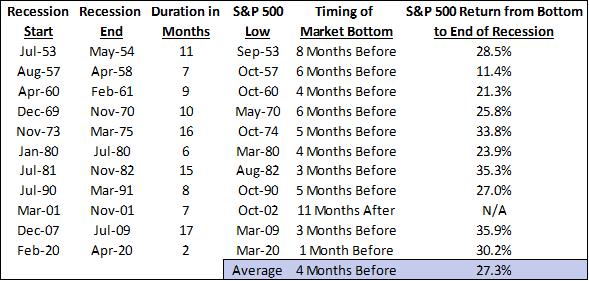

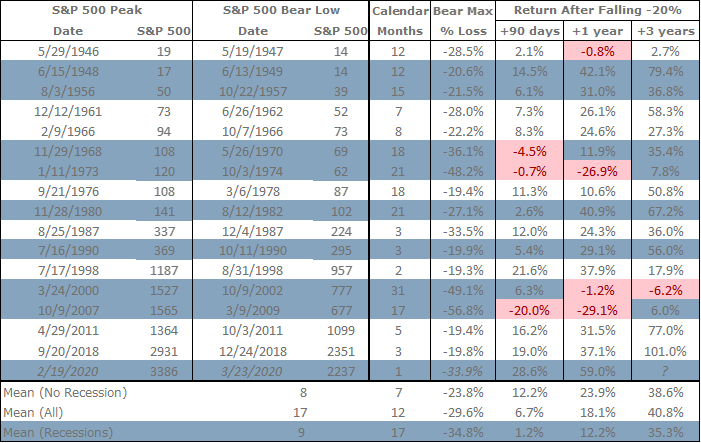

A late-day rally on Friday staved off the almost inevitable bear market. Odds of a recession have been moving higher, with weakness in retailers’ earnings reports last week. If history is a guide, this downturn should be a long-term buying opportunity for those able to add to stock positions.

Glenview Market Update: Bear Market Primer

Berkshire Hathaway’s Portfolio Moves In The First Quarter 2022

Berkshire Hathaway’s Portfolio Moves In The First Quarter

Berkshire’s $364 billion concentrated investment portfolio consists of 49 companies and is very focused, with energy stocks now among the most significant exposure. There were eight new purchases, and Berkshire added to stakes in seven companies. Berkshire is the largest holder of Paramount Global.

Glenview’s Bill Stone On The Impending Bear Market And Recession

Four Lessons From Warren Buffett And Charlie Munger

Four Lessons From Warren Buffett And Charlie Munger

Buffett and Munger’s partnership in managing Berkshire Hathaway has produced arguably the most remarkable extended performance for investors ever recorded. As market volatility has ramped up along with uncertainty, it is an optimal time to revisit four timeless lessons.

Glenview’s Stone On Fox Business From The Berkshire Hathaway Annual Meeting

Highlights From The Berkshire Hathaway Annual Meeting

Crucial Takeaways From Berkshire Hathaway’s Q1 Earnings

Crucial Takeaways From Berkshire Hathaway’s Q1 Earnings

Berkshire’s quarterly earnings of almost $5.5 billion fell by 53% versus the same quarter in 2021. Operating earnings, which remove the distortion from market changes, rose fractionally by 0.3%. Due to share repurchases, per-share operating income for 1Q increased by 4% versus 2021.